Usually your credit score is also known as FICO score. The calculation of this score is done solely on the five factors.

● Credit mix

● History and length of credit

● New credit

● Amount that you owe

● Payment history

Although there are other credit scores than the FICO. But the most common type of measuring your eligibility to take a debt is FICO. Lenders use this method to determine if you are eligible to do business with or not. We do not know the calculation method of FICO but it sure tells us that five factors are going to influence the calculation. Taking a look at those factors in detail will help us understand how this business works.

Total percentage of each factor in FICO credit score history depends upon the factors. The calculation method is not known but we do know that the categories and their percentages influence the decision.

● Credit mix ( 10%)

● History and length of the credit (15%)

● New credit (10%)

● Amount that you owe (30%)

● Payment history (35%)

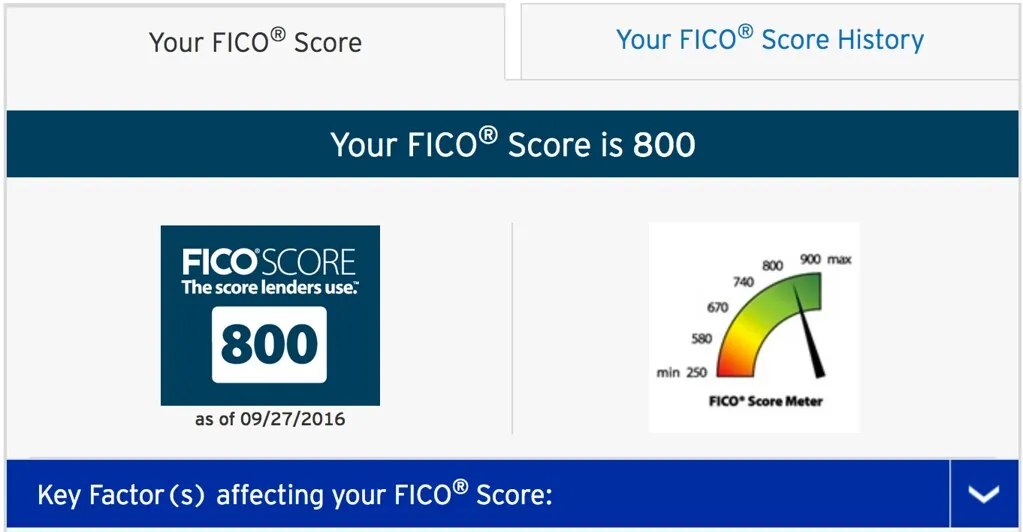

These categories are looked upon at the time of calculation of your credit score. Typically, your credit score can go from 300 to 850.

Credit mix

Different types of credit accounts under your name show lenders that you can handle the credit mix easily. It can include the evolving credit instalment credit as the lines of credit to represent how stable you are in paying payments.

History and length of credit

If you have the credit accounts, which are open for a longer period of time and also standing in a really steady place which means you are paying your amount consistently and you have never been late in paying a payment.

New credit

Wherever you go for a new credit account, it means you are under a lot of financial pressure. And usually it shows your impatience regarding the payment history. This could mess up your credit score a little. It is always smart to think before taking out an extra credit. You need to understand if you really need it or not because Taking it will mess up your credit score.

Amount that you owe

This is another factor that influences the decision and calculation relatively on a large scale. This category focuses on the amount that you currently have in your debt. Which means the different accounts and their types are also included. If you have a large amount of debts, then it will completely change your credit score and its guarantee.

Payment history

Usually these categories contain if you are paying your amount that you owe to the lender consistently or not. Also, if you have any bankruptcy, delinquencies and collections the payment history factors all of these two. If you have issues in your credit history then your credit score will lower by the time.